Voucher in AccountingWhat is a Voucher?A document that is used by the accounts payable department of an organization to collect and file all the supporting documents required to approve the payment of liability is known as a voucher in accounting. It is the memorandum of liability for a company. The government of a country can also issue the voucher which is redeemable for various programs such as school choice, housing, or social welfare initiatives.

Also, a document such as a coupon or a ticket that can be redeemed for some goods or services is termed a voucher. Such vouchers are generally issued in the hospitality industry such as hotels, restaurants, malls, airlines, etc. These vouchers can be exchanged for rooms, flights, shopping items, fares, etc. Understanding Accounting Vouchers in DetailA voucher works as a backup document for accounts payable. These are the short-term bills owned by companies to vendors and suppliers. A voucher plays an important role in the internal accounting control mechanism which makes sure that every payment is properly authorized and the goods and services purchased are received. A company has a number of short-term financial obligations to the suppliers and vendors during a financial year. The suppliers of raw materials or inventory may grant an extension of credit to the company to make the payment in the near future generally within a period of 30, 60, or 90 days.. A voucher along with all of the supporting documents presents the money owed and payments due to the suppliers or vendors. All the vouchers and other necessary supporting documents are recorded in the voucher register. Process of Creating Accounting VouchersIt is not always possible to make and/or receive the payment of goods and services immediately. This payment is usually due at a certain future date. So, in order to avoid fraud by a party in the future or any other uncertainty, the organization receives goods or services and issues an accounting voucher which works as evidence and a reminder for the payable amount. The following steps should be followed to create a voucher:

Requirements of a VoucherVarious supporting documents required in a voucher include the followings:

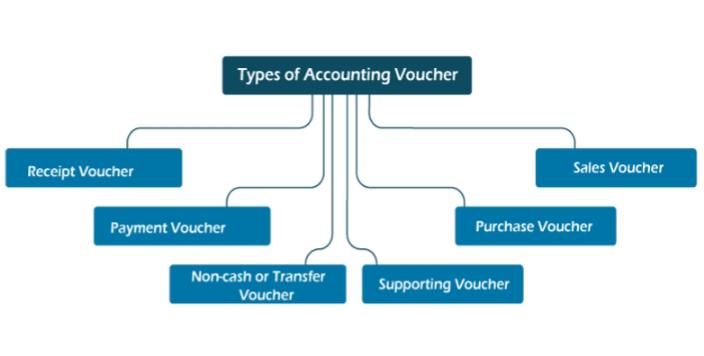

Types of Vouchers

Generally, there are six types of vouchers used in accounting. They include the followings: 1. Receipt VoucherThis voucher is used to record the cash or bank receipts of a company. It shows an inflow of funds in the organization. Receipt vouchers can be further divided into two types:

2. Payment VoucherThis voucher is just the opposite of the receipt voucher. In the receipt voucher, the cash or bank was debited while in this case, the cash or bank will be credited. It shows an outflow of funds from the organization. These vouchers are used to record the payments done by the company via cash or cheque. Payment vouchers can also be further divided into two types:

3. Non-cash or Transfer VoucherNon-cash or transfer vouchers (also called journal vouchers) are used to fulfill the purpose of non-cash transactions. They are used as documentary evidence, e.g., goods sold on credit. In such cases, there is not any effect noticed on the cash or bank account of the assessee. When the goods will be sold on credit, the voucher would debit the Debtor to whom the credit sale of goods is made while the sale on credit account would be credited further. 4. Sales VoucherAny sales transaction for the goods and services is passed in the sales voucher. This voucher is prepared and maintained with the prime aim of recording the cash and credit sales that are performed by the company. While recording the transaction in the voucher, the relevant debtor account is debited and the sales account is credited. A sales voucher is the proof and acts as evidence in case of any issue in the future related to the sales transactions for the goods and services in the business. 5. Purchase VoucherIn the purchase voucher, the transactions related to the purchase of goods and services in a company are recorded. The purchase transaction can be done via cash, bank, or credit. In the case of a credit purchase, the relevant supplier is credited. Several relevant documents are used to support the purchase voucher such as the purchase order, supplier slip, and other documents. 6. Supporting VoucherThese vouchers also work as documentary evidence of transactions that have taken place in the business. As clear from the name, they work as the supporting voucher to the primary voucher. For example, you can attach a bill of expense along with the original voucher because it will support the primary voucher. One of the most common examples of a supporting voucher in day-to-day life is the petrol bills attached with the conveyance vouchers. Benefits of Accounting VoucherTo make the payment process smooth and appropriate, an organization must maintain a complete and accurate record of financial transactions in various vouchers. A voucher works as a document of proof in any legal process and acts as the same in the verification process of auditing. Some of the prime benefits of maintaining vouchers are given below:

Next TopicAdvantages of Accounting

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share